Stock Idea

Update

01/12/23 *This is general advice only

Following up from our prior entry around the $62 area, ASX retreated further, reaching a low in the mid $50’s. In the last couple of months we have seen the price reach between the 50 and 61.8% retracement where it has held steady, appears to have found support and has marginally bounced, currently trading just below $58.

This poses an opportunity to add to the position or to enter the holding with a long term view as discussed on the earlier coverage of the stock (please refer to the recommendation as of the 13/8/23).

See below chart ⬇️

About the company

ASX Limited (ASX) operates Australia's primary national securities exchanges. This include the provision of securities exchange services, derivatives exchange services, central counterparty clearing services, and registry, settlement, and delivery-versus-payment clearing financial products and associated ancillary services. It also provides market data services and investor education courses.

The Technicals

* Please note this is general advice only

The ASX holds a pivotal position within Australia's capital markets, functioning effectively as a distinct monopoly. Contrary to prevailing sentiment, we view these currently discounted levels not as a cause for concern, but rather as a compelling buying opportunity. In our strategy, the ASX stands out as a key component of our long-term, quality-focused approach. We actively seek out instances of undervaluation, such as the present, to capitalize on potential gains.

It's noteworthy that over the years, we've witnessed only two instances of a profound retracement since the late 90s. This occurrence echoes a previous episode during the global financial crisis (GFC), which is vividly portrayed on the chart below. This historical context informs our perspective as we navigate these market dynamics.

We hold a favorable stance on acquiring the stock at its present valuation, fully embracing the concept of dollar-cost averaging. This strategy allows us to confidently consider accumulating additional shares should the stock experience further declines, aligning with our overarching long-term perspective, as previously emphasized.

The prevailing trajectory of the stock signals a clear long-term upward movement, a journey that has seen it progress consistently from the lower left quadrant to the upper right, a reassuring indicator of its potential for sustained growth.

ASX

| 2020 Y | 2021 Y | 2022 Y | |

| REVENUE PER SHARE | 7.10 | 6.63 | 7.80 |

| OPERATING MARGIN (%) | 69.25 | 67.25 | 67.49 |

| NET INCOME, GAAP | 722 | 641 | 737 |

| LONG TERM DEPT | 104 | 83 | 83 |

| ROIC | 11.71 | 11.33 | 13.18 |

| RETURN ON CAPITAL | 14.59 | 12.64 | 14.34 |

| RETURN ON EQUITY | 13.48 | 12.65 | 14.34 |

| FREE CASH FLOW | . | . | . |

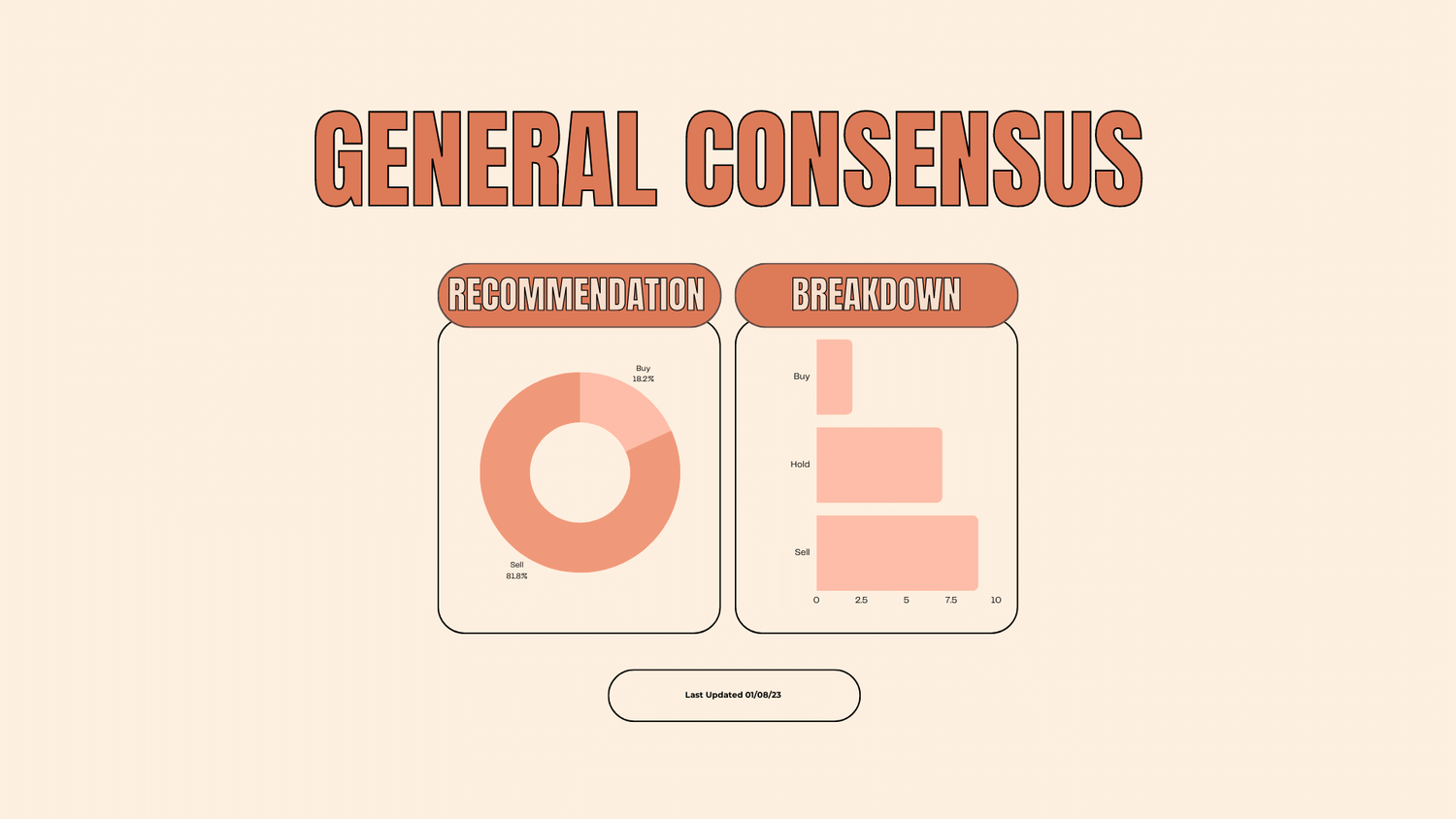

General Consensus

Out of the 18 analysts that cover the stock the general consensus remains challenged. Only two have a buy recommendation whilst the rest have a hold or a sell on the stock.