Stock Idea

About the company

Codan Limited (CDA) designs and manufactures a range of electronic products and associated software to governments, businesses, aid & humanitarians and customer markets. CDA has manufacturing and corporate offices in Australia and Canada, with overseas representative offices in USA, UK, Ireland, China, United Arab Emirates and India.

The Technicals

* Please note this is general advice only

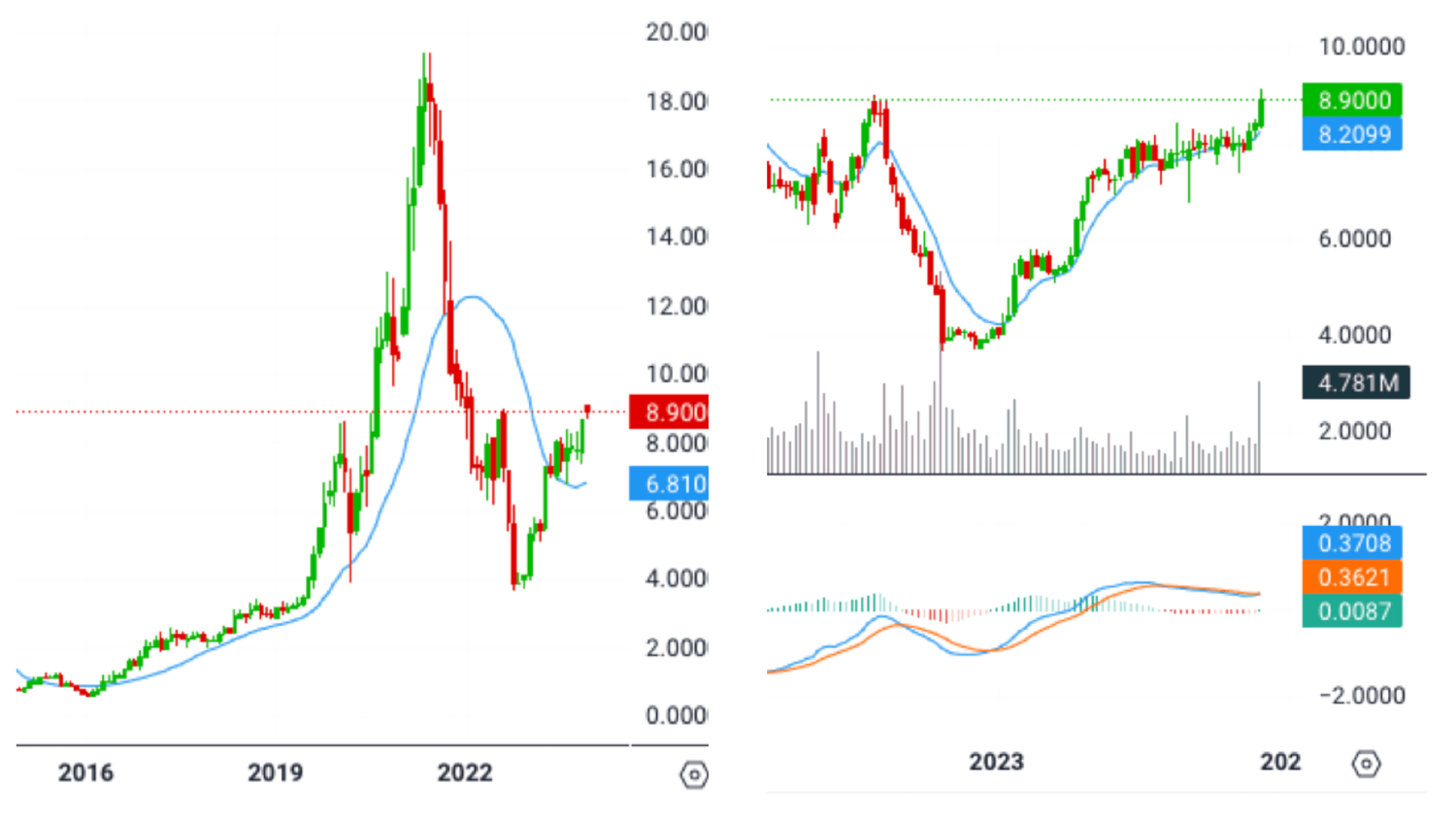

Monthly Chart on the Left - Weekly Chart on the Right

The monthly chart on the left shows the stock currently trading above the 21 monthly exponential moving average. You’ll notice that when the stock had it’s incredible rally from 2016 onwards it was also trading above the blue line (21ema).

The chart on the right shows clearly that the stock broke out of it’s recent consolidation and it has the MACD indicator creeping back up.

The stock is currently trading at $8.59 as I am writing this. We are going to give it some room to move, so we will set the stop at $7.35 with an initial target at $12.15, followed by $15.35 and leaving some skin in the game for all-time highs.

* Please note this is general advice only

CDA

| 2020 Y | 2021 Y | 2022 Y | |

| REVENUE PER SHARE | 1.93 | 2.42 | 2.80 |

| OPERATING MARGIN (%) | 22.12 | 22.75 | 22.41 |

| NET INCOME, GAAP | 64 | 90 | 101 |

| LONG TERM DEPT | 247 | 304 | 368 |

| ROIC | 22.01 | 25.17 | 20.22 |

| RETURN ON CAPITAL | 35.99 | 36.37 | 31.31 |

| RETURN ON EQUITY | 39.35 | 43.67 | 39.15 |

| FREE CASH FLOW | 0.55 | 0.70 | 0.25 |

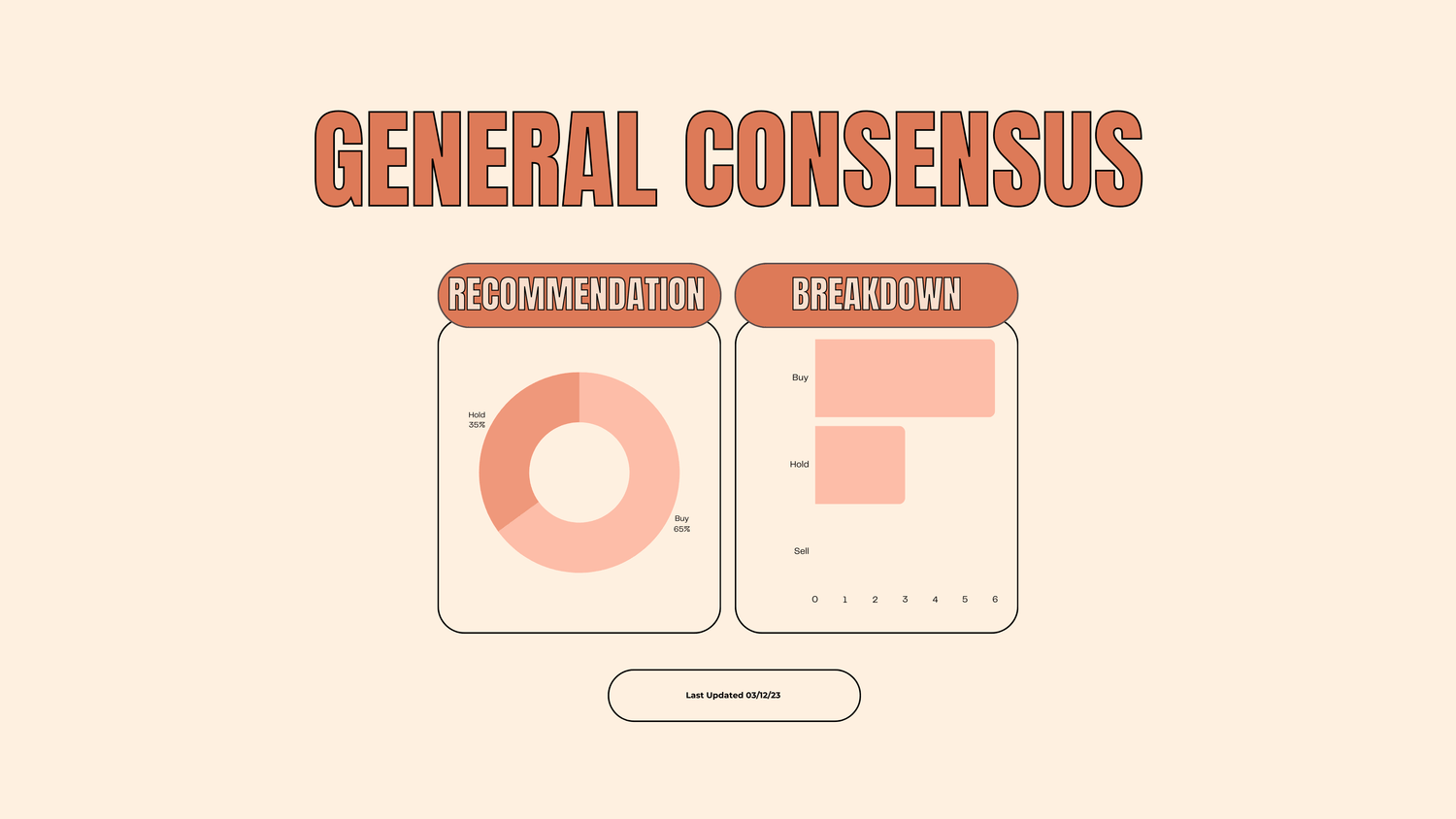

General Consensus

The general consensus is leaning towards a buy with 6 analysts supporting the stock and with 3 having it as a hold.