Stock Idea

About the company

Charter Hall Group (CHC) is a property fund manager and developer managing a suite of institutional, wholesale and retail unlisted property funds in which it holds investments. The funds are diversified across the office, retail, industrial and residential sectors. CHC has offices in Sydney, Melbourne, Brisbane, Adelaide, and Perth. CHC's business comprises two divisions namely property investments, and property funds management.

The Technicals

* Please note this is general advice only

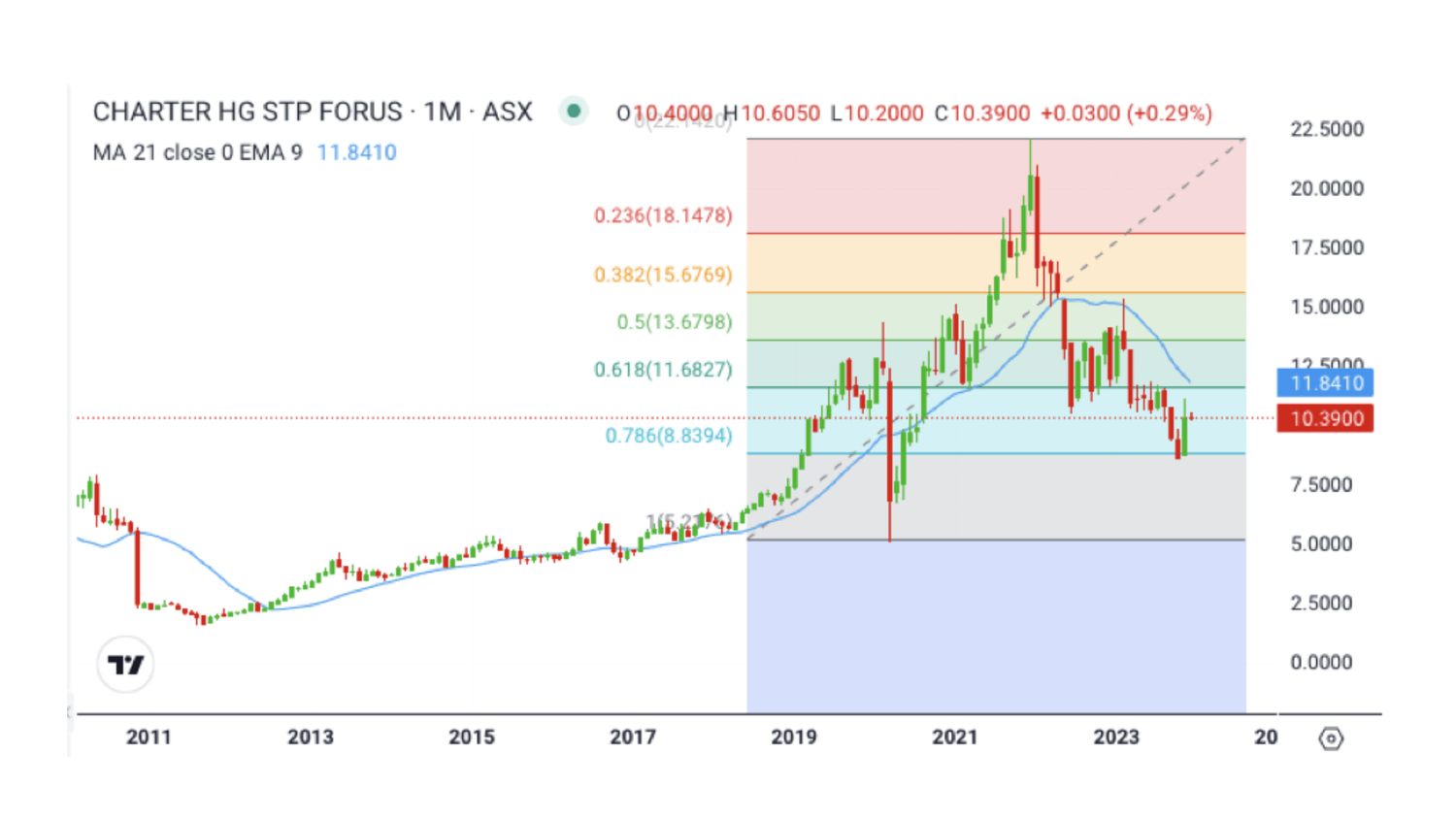

CHC is one of our Quality stocks (please see our definition under “A Quest For Value” on our website). The recent pullback to the 78.2% retracement from the all time highs, alerted us to the opportunity and the recent bounce from that level confirmed it. As this is a long term play. In the event of a further decline we would look to add to the position in order to dollar cost average.

We are comfortable only averaging down on our quality shares as they represent a long term hold and not on other technical buy opportunities. If and or when this stock no longer represents a long term buy, we will alert you of the fact. With the stock currently trading at $10.39, we are comfortable paying up to $10.67.

* Please note this is general advice only

CHC

| 2020 Y | 2021 Y | 2022 Y | |

| REVENUE PER SHARE | 1.06 | 1.30 | 2.19 |

| OPERATING MARGIN (%) | 44.47 | 28.18 | 48.64 |

| NET INCOME, GAAP | 348 | 496 | 927 |

| LONG TERM DEPT | 375 | 460 | 473 |

| ROIC | 7.39 | 5.36 | 12.06 |

| RETURN ON CAPITAL | 14.79 | 17.79 | 27.32 |

| RETURN ON EQUITY | 17.18 | 21.99 | 32.79 |

| FREE CASH FLOW | 0.85 | 0.47 | 1.26 |

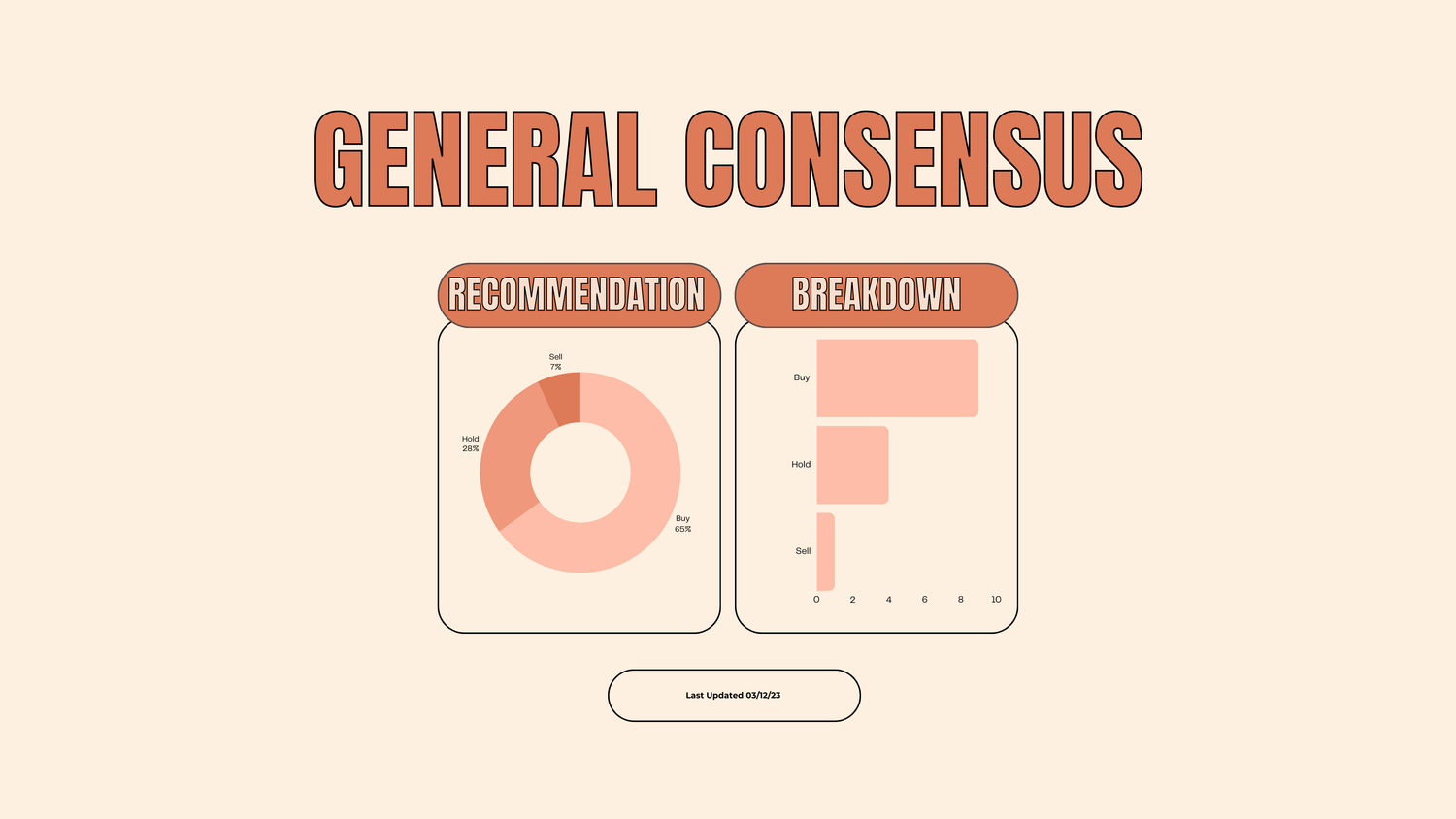

General Consensus

The general consensus on the stock is a buy, with 9 brokers calling it a buy, 1 a sell, and 4 a hold.