Stock Idea

Update

04-10-2023

*This is general advise only

With market forces weighing to the downside and HZN approaching a dividend, a prudent approach or strategy is to exit the trade as the stock is still trading within the upper limit of the buy recommendation (up to 17.5c). It is vital that we protect capital during such market environments. The 2c dividend practically warrants the stock pulling back by at least 2c and in some cases more. If a market sell-off was to eventuate and accelerate, would only mean a greater amount of buy opportunities. Liquidity in such instances is a blessing.

The decision to exit a trade in a stock like HZN when market forces are weighing on it and a dividend is approaching can depend on various factors, including ones investment goals, risk tolerance, and the specific circumstances of the stock and the broader market. Here are some considerations to keep in mind:

Investment Goals: Consider your long-term investment goals. Are you a short-term trader looking to profit from short-term price movements, or are you a long-term investor looking for a steady income and potential capital appreciation over time?

Risk Tolerance: Assess your risk tolerance. If market forces are indicating a potential downturn, are you comfortable holding onto the stock and potentially seeing a decrease in its value? Or do you prefer to exit to protect your capital?

Dividend Expectations: Consider your expectations for the dividend. If you expect a 2c dividend and anticipate the stock's price to drop by at least 2c after the dividend payout, you may want to exit the trade before the ex-dividend date to avoid the potential loss.

Market Environment: Evaluate the overall market environment. If you believe that a broader market sell-off is likely and that it could impact HZN negatively, it might be prudent to exit the trade to protect your capital. However, predicting market movements is challenging, so be cautious about making decisions solely based on market predictions.

Liquidity: As I mentioned, liquidity can be crucial. Having liquidity on hand allows you to take advantage of new opportunities or respond to changing market conditions.

Research: Ensure that your decision is based on thorough research and analysis of HZN and its financial health, as well as the broader economic factors that may affect its performance.

Ultimately, the decision to exit a trade should be based on your individual circumstances and investment strategy. It's essential to weigh the potential benefits of protecting your capital against the possibility of missing out on further gains if the market does not move as expected. Additionally, consulting with a financial advisor or investment professional can provide valuable insights tailored to your specific situation.

About the company

Horizon Oil Limited (HZN) is an oil and gas exploration, development and production company with projects located in New Zealand, Papua New Guinea and China. The company focuses on three main areas, being the producing Maari field offshore New Zealand, and assets under development in China.

The Technicals

*Please note this is general advice only

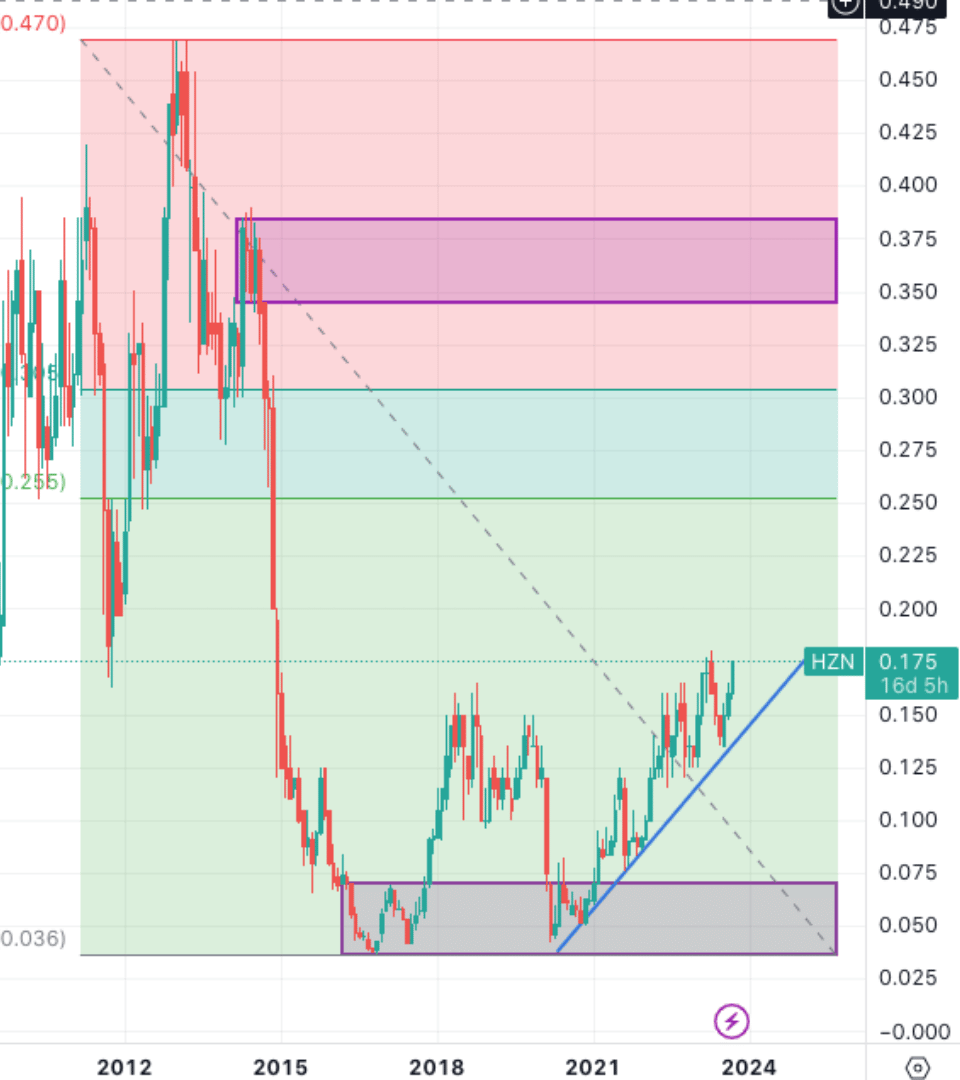

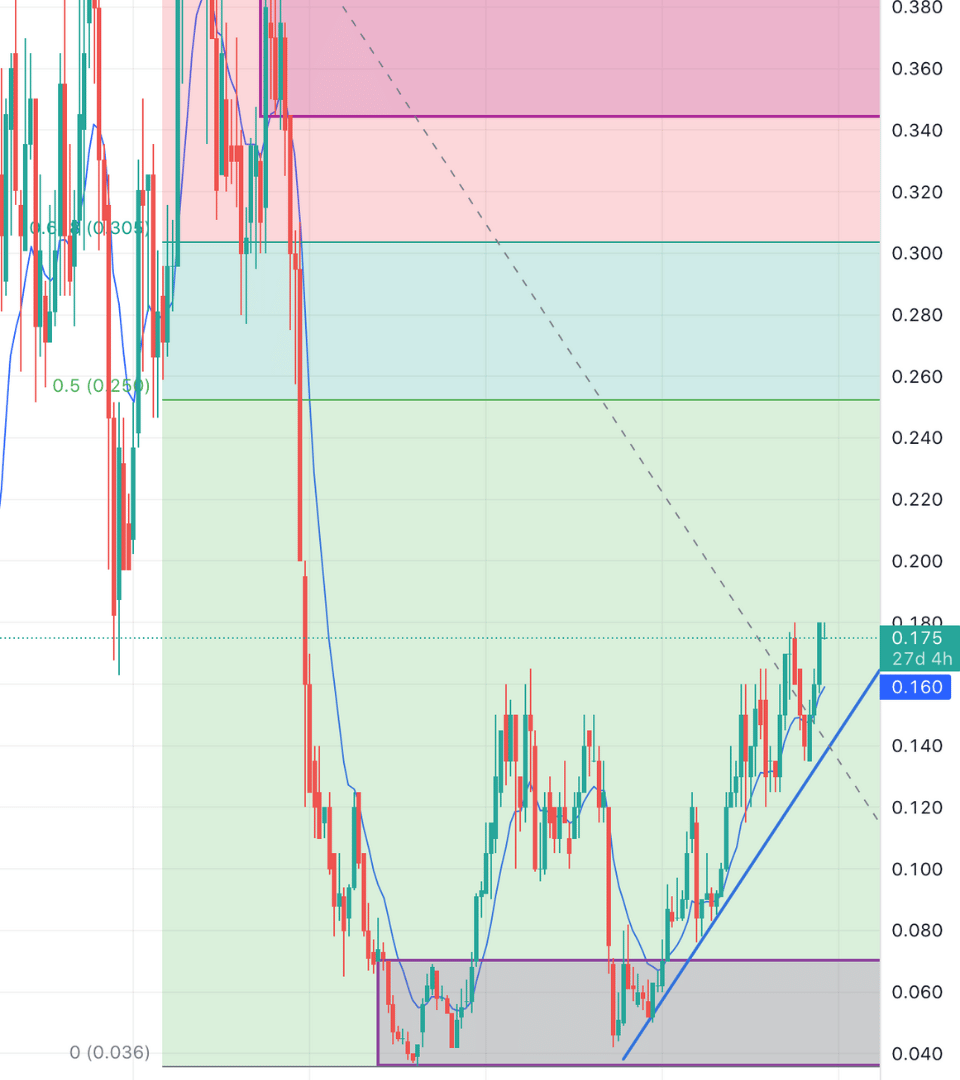

When analyzing the monthly chart of HZN, it becomes evident that the stock has established a robust support level since 2016, which remains intact to this day. Despite a brief retracement to this base in 2020, the stock has consistently formed higher highs and higher lows, indicative of an ascending trend. It's important to note that while it may have been ideal to enter the trade during those low points, such opportunities weren't accessible at the time. Remember, it's challenging to precisely pinpoint the market's top or bottom, but we can certainly participate in the price range between these extremes.

Turning our attention to the weekly chart on the right, we can delve into the finer details of the trade. HZN currently presents a compelling buying opportunity, with a suggested entry point at 17.5 cents and a recommended stop loss set at 13 cents to manage risk. My initial price target stands at 24.5 cents, followed by subsequent targets at 30 cents and 34 cents. It's crucial to be aware that the stock will go ex-dividend on the 17th of October, distributing 2 cents per share to shareholders. Factor this into your decision-making process when considering your trading strategy.

*Please note that the team at Tradeprofitably has exposure to the stock