Stock Idea

About the company

Magellan Financial Group Limited is a publicly owned investment manager. It invests in global equities and global listed infrastructure markets across the globe. Magellan Financial Group Limited was founded in 2004 and is based in Sydney, Australia.

The Technicals

The stock's downfall has led it back to a base level not seen since early 2013, as seen on the left side of the monthly chart below. The stock faced significant selling pressure, but in recent weeks, there has been a slowdown and a change in direction, as displayed below on the right side of the weekly chart.

This shift in momentum occurred when the stock returned to its foundational level. Now, it's showing a different pattern, making higher highs and higher lows, suggesting a change in its behavior.

Interestingly, just as the stock formed strong bases during its rise, it also created solid ceilings during its fall. These ceilings have now turned into potential levels where the market could be drawn to next to the upside.

*Please note this is general advice only.

MFG has provided us with a buy opportunity. Friday's closing price was at $9.80. I am comfortable with a buy no higher than $10 and a hard stop (exit) at $7.51. This may seem like a big stop to some but my first target is $28.02 followed by $31.84. A risk to reward of a little more than 7 times. Finally it's important to be aware that the company is reporting its quarterly this coming Friday the 18/8 (where anything is possible & probable) and that the team at Tradeprofitably has exposure to the stock.

MFG

| 2020 Y | 2021 Y | 2022 Y | |

| REVENUE PER SHARE | 5.52 | 5.16 | 4.28 |

| OPERATING MARGIN (%) | . | . | . |

| NET INCOME, GAAP | 574 | 354 | 555 |

| LONG TERM DEPT | 22 | 16 | 14 |

| ROIC | . | . | . |

| RETURN ON CAPITAL | 55.66 | 37.10 | 57.55 |

| RETURN ON EQUITY | 33.13 | 19.46 | 16.95 |

| FREE CASH FLOW | 1.51 | 1.65 | 1.43 |

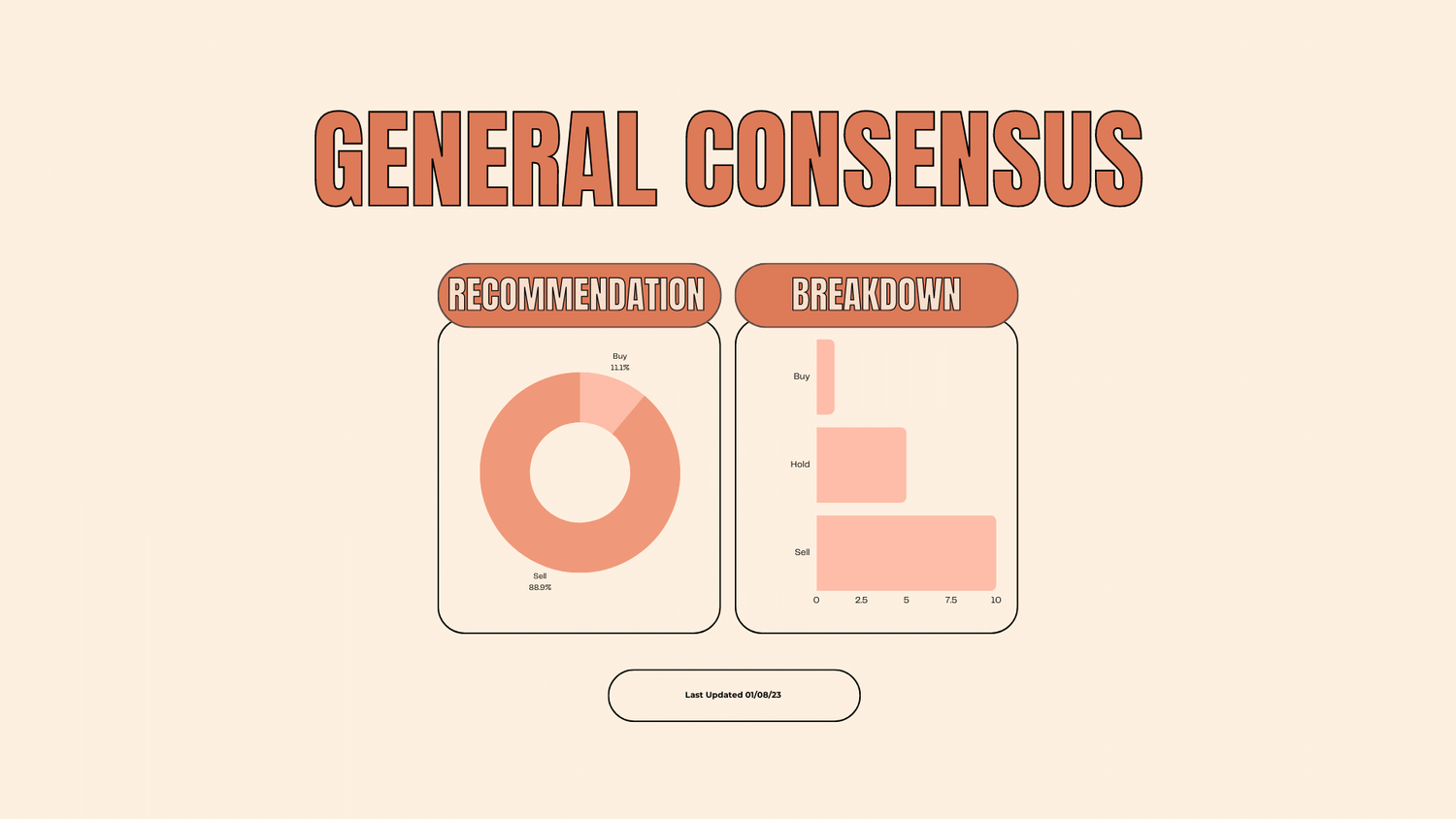

General Consensus

Amidst the scrutiny of 16 astute analysts, the stock emerges from the haze with a singular buy rating, accompanied by the measured stance of 5 holds, and a formidable front of 10 sells. However, a deeper exploration into the technical intricacies paints a distinct narrative – one that challenges the prevailing consensus.