Stock Idea

About the company

Paladin Energy Limited (PDN) is a uranium production and exploration company with projects currently in Australia, Canada, and Africa. The Langer Heinrich Mine in Namibia is its flagship project.*Please be aware that although Paladin is listed on the ASX200 and holds a current market capitalization of 2.55 Billion, it's categorised as a small cap in my assessment. This decision is influenced by its share price and the notable volatility it displays.

The Technicals

* Please note this is general advice only

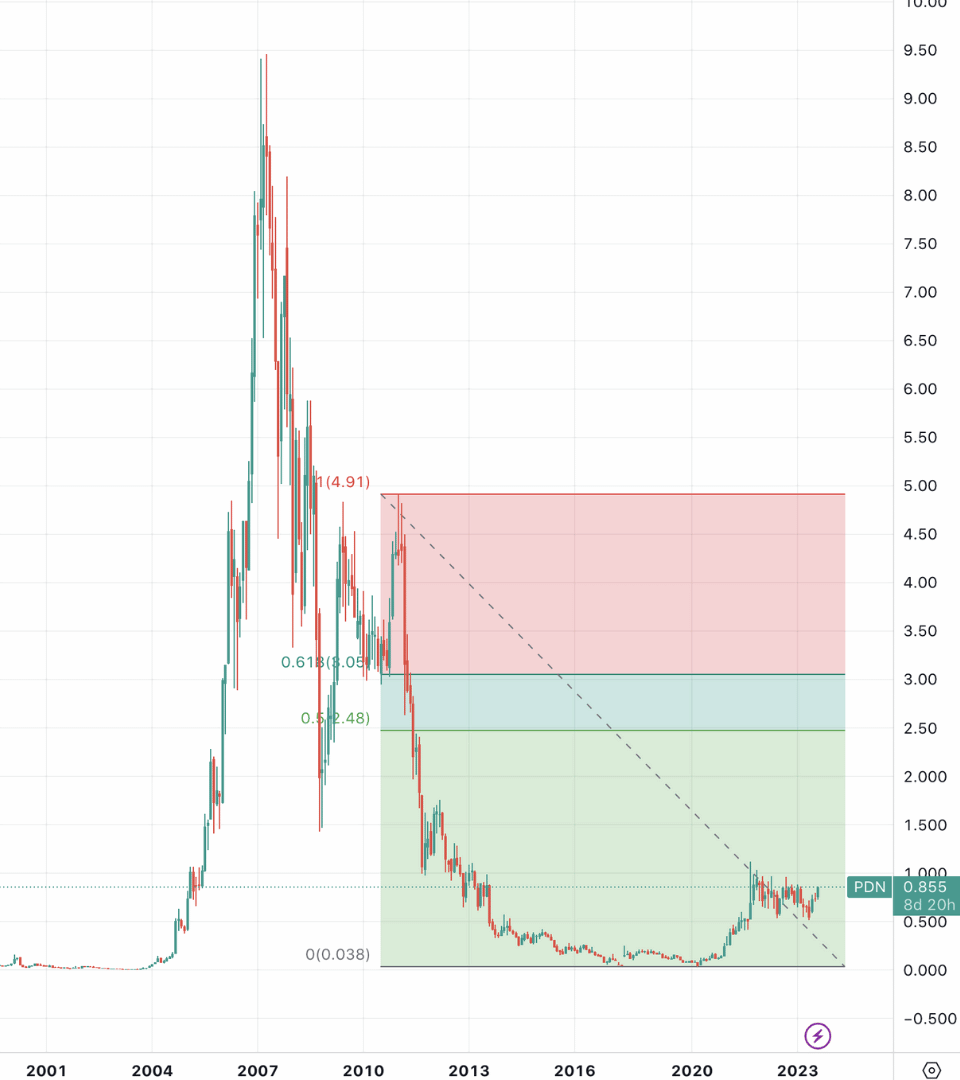

The monthly chart of PDN reveals its inclination for significant price movements in both upward and downward directions. Notably, a parabolic surge in 2007 drove the stock's value to nearly $9.50, followed by a subsequent retraction to a foundational level established as far back as 2004. Throughout recent years, PDN has consistently respected this foundational support level, frequently utilising it as a pivotal reference point. Furthermore, a visible upward trajectory has emerged over recent periods, indicative of a bullish undercurrent.

Over the past twelve months, a consolidating channel pattern has taken shape, effectively containing the stock's price fluctuations. This consolidation phase suggests an imminent directional move, poised for a breakout that will define the next significant movement for PDN. A comprehensive assessment of recent market dynamics, combined with incremental upward strides, supports the idea that PDN is drawn to higher prices.

*Please be aware that Paladin is scheduled to release its preliminary report this upcoming Friday the 25/8

PDN presents a buying opportunity, with our buy threshold extending to 90 cents per share. Our protective stop loss is set at 49 cents.

While the stop might seem substantial, it closely aligns with the recent low before the subsequent rebound. This decision is based on our objective technical analysis. Furthermore, we're allowing the stock some leeway in light of the imminent announcement scheduled for this upcoming Friday.

Our profit objectives are set at $2.48, followed by $3.05 and $4.18.

This strategic move offers a potential risk-to-reward ratio of 1 to 3.43, contingent upon the achievement of the $2.48 target price.

*Please note that the team at Tradeprofitably has exposure to the stock

PDN

General Consensus

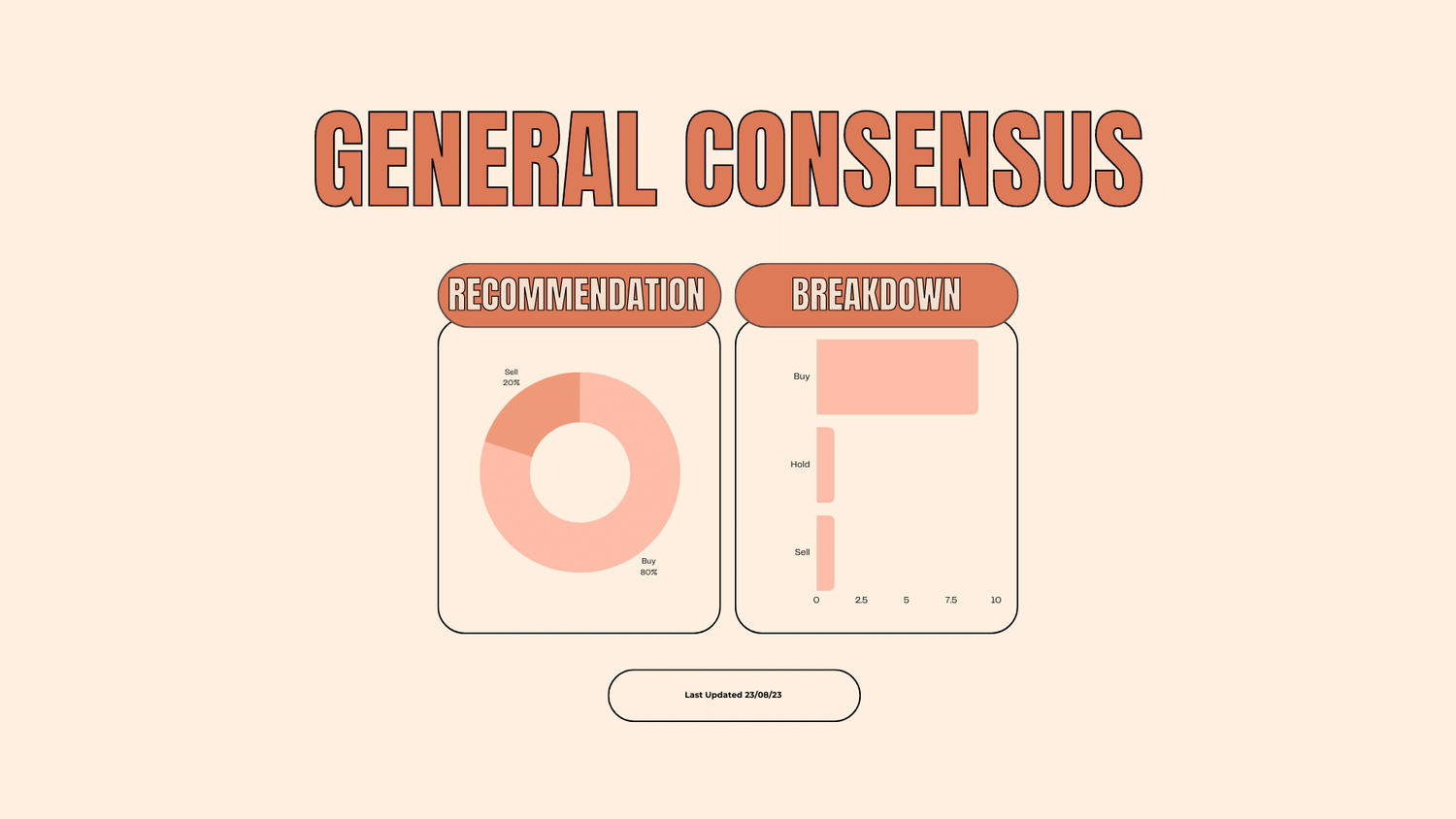

The collective assessment from brokerage experts strongly leans towards a "buy" recommendation, as indicated by the consensus of 9 brokers advocating for a purchase, 1 recommending to hold, and 1 suggesting to sell.