Risk Management

Risk Management

Risk Management: The Core of Trading Success

Risk management is the cornerstone of a successful trading career. While most traders focus heavily on entry and exit strategies, no strategy—no matter how advanced—can consistently yield profits without robust risk and money management. Let’s discuss a way one can protect and grow ones capital.

The Progressive Risk Approach

When you're just starting, adopting a conservative risk approach is critical. Begin by risking no more than one-third of 1% (0.33%) of your trading capital on a single trade. This protects your account, ensuring you can survive a series of non-progressive trades and continue learning and growing without devastating losses.

Once you’ve achieved three consecutive profitable months, defined by steady account growth rather than the number of winning trades, you can cautiously increase your risk to 0.5% per trade.

After another three profitable months at the 0.5% level, you can then consider risking up to 1% per trade. This progressive increase in risk allows you to scale your trading responsibly while developing consistency and discipline.

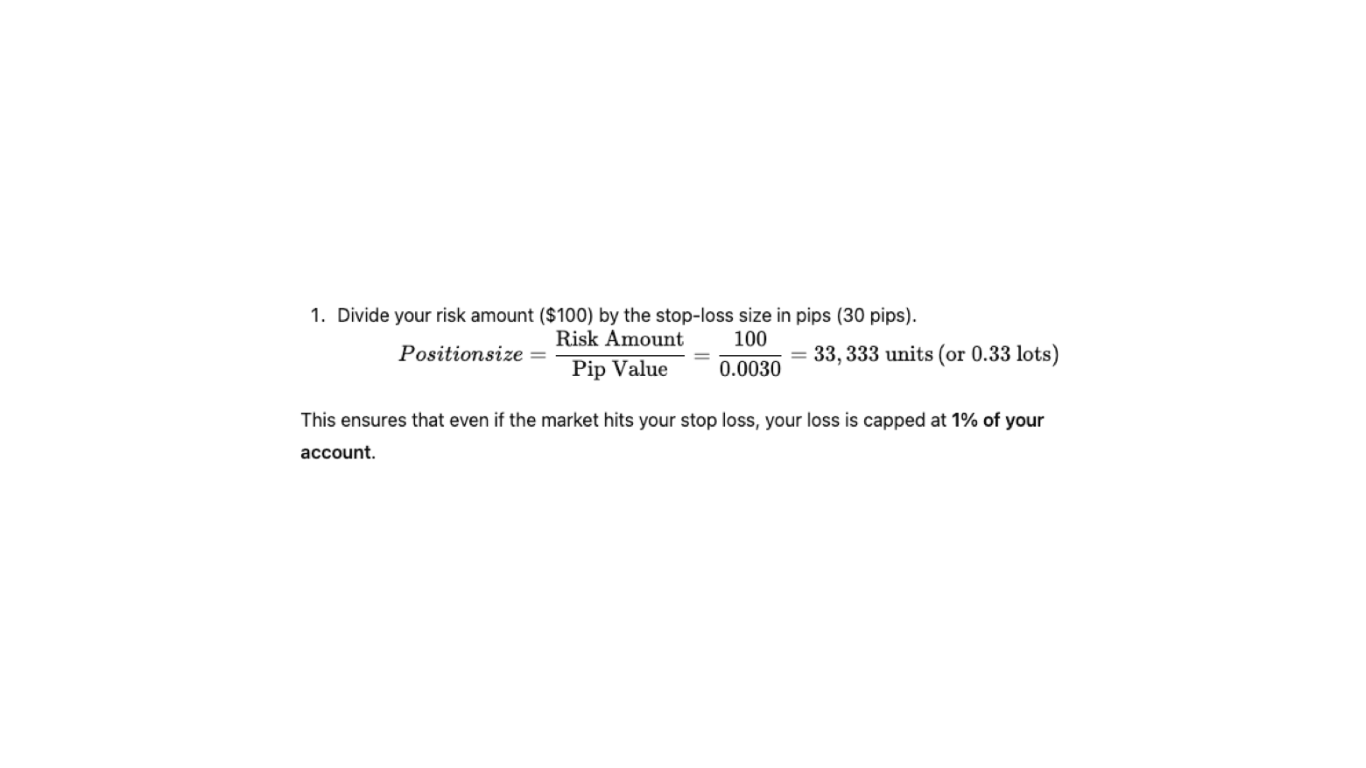

Example: Position Sizing in Forex

Let’s say your trading account has a balance of $10,000, and you’re risking 1% per trade. That means your maximum allowable risk is $100 per trade, including transaction costs.

You're trading EUR/USD with a stop loss set at 30 pips (0.0030). To calculate your position size:

Managing Volatility Around News Events

Currency markets often experience volatility spikes around high-impact news releases. We have discussed how to manage this risk, but here is a refresher:

Use an economic calendar, such as the one on ForexFactory.com, to identify "red flag" events.

Avoid entering trades just before major announcements.

If already in a trade, tighten your stop-loss to mitigate potential slippage.

Use a guaranteed stop

Slippage occurs when price moves rapidly, and your trade executes at a less favorable price than expected. By staying aware of upcoming events, you can safeguard your trades against unpredictable price movements.

The Importance of High-Probability Trades

Only take trades with a minimum risk-to-reward ratio of 2:1. For every $1 you risk, aim to make at least $2. This approach ensures that even if a portion of your trades are non-progressive, the winners will more than offset the losses.

Referring to losing trades as “non-progressive” rather than losses shifts your mindset, helping you stay focused on learning and improving. Each trade is a step closer to mastery.

Limiting Trades per Session

To prevent overtrading and emotional decision-making:

Take no more than three trades per session.

If your first trade is profitable, consider stopping for the session to lock in gains.

Remember, it’s not about how many trades you take, but about the quality and probability of each setup.

Protecting Your Capital: A Practical Comparison

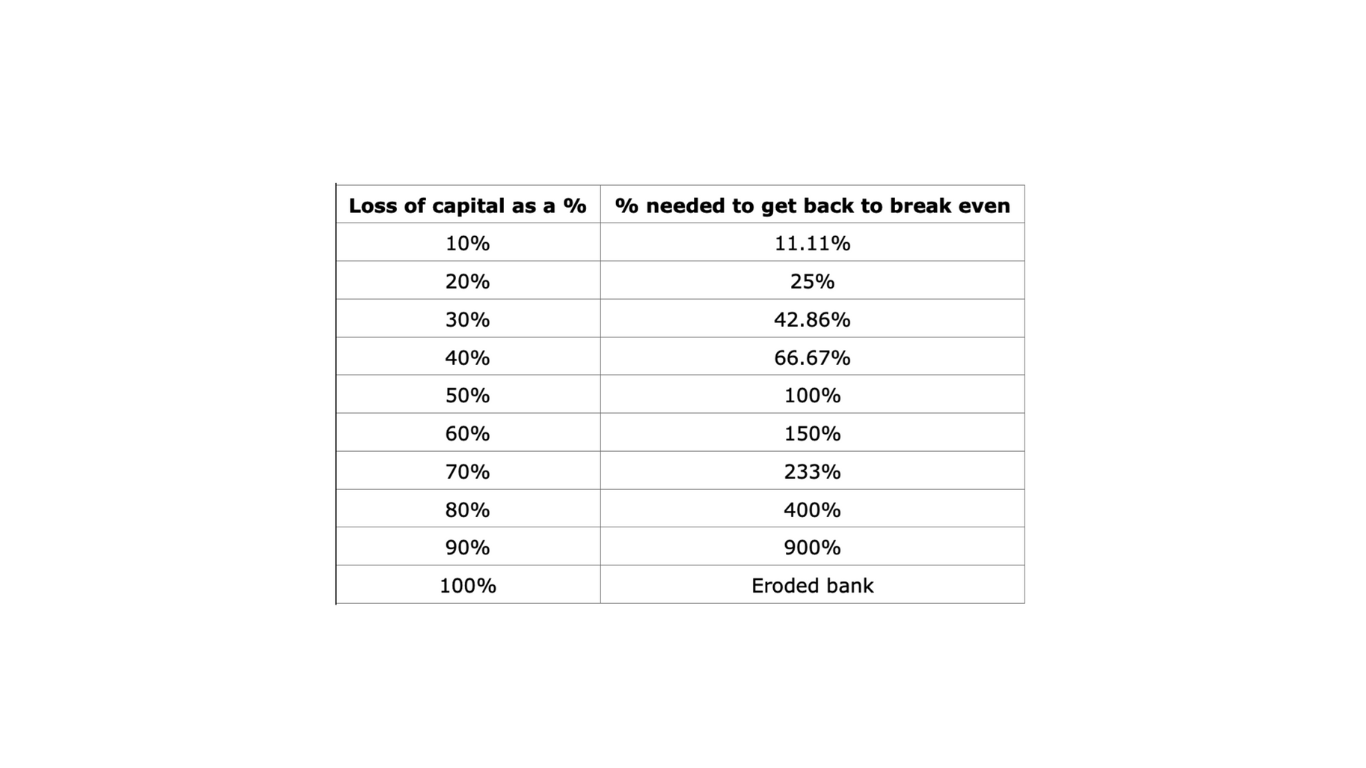

To illustrate the importance of proper risk management, consider two traders, both starting with a $10,000 account.

Trader A risks 1% per trade: After 10 consecutive losing trades, their account is at $9,048, a drawdown of just under 10%.

Trader B risks 10% per trade: After 10 consecutive losses, their account drops to $3,486, a catastrophic 65% drawdown.

Recovering from a large drawdown becomes exponentially harder. For example, a 20% loss requires a 25% gain just to break even. This is why preserving capital is the first rule of trading.

Final Thoughts

Your goal is to preserve capital first and make money second. Adhere to strict risk management principles, focus on high-probability trades, and scale your risk responsibly. The market will always be there—your job is to ensure that your account is, too.

By understanding and respecting the principles of risk management, you’re not just trading—you’re building a sustainable trading career.

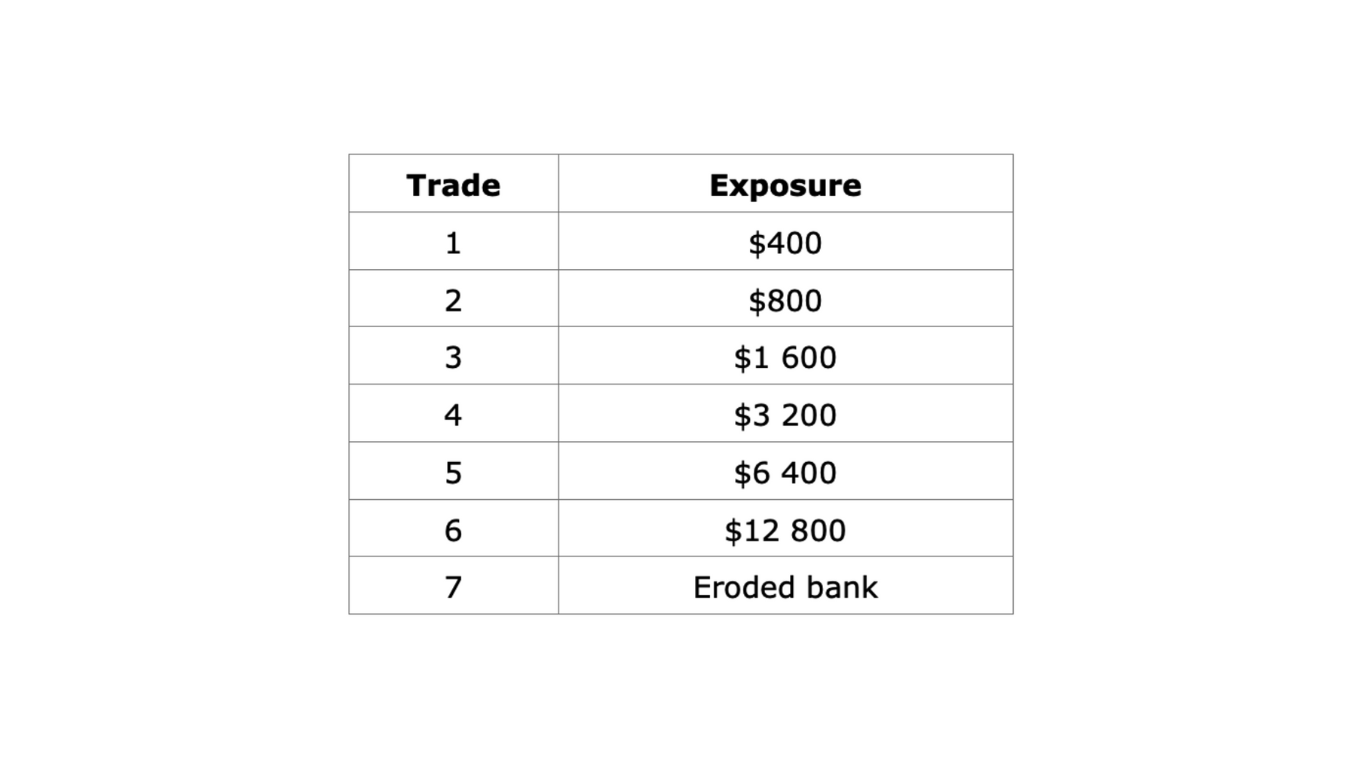

Avoiding the Temptation to Double Down

Doubling your risk after a losing trade may seem like a quick way to recover, but it’s a recipe for disaster. Losses are part of trading. What matters is your ability to protect your capital, learn from mistakes, and stay in the game.

Do not double down; below is an example of all the things to not do. Risking an initial 2% on the first trade on a $20,000 bank and then doubling up after every non progressive trade. 1% risk per trade Vs 10% risk per trade

Remember the name of the game is to preserve capital and make it grow.

The columns below are self explanatory;

A comparison of risking 1% per trade compared to 10% per trade (we are all going to get a string of losses, with appropriate money management, ones guarantees longevity in this business)