Stock Idea

About the company

Ramelius Resources Limited (RMS) is a gold mining and production company with its primary production being focused on the Mt Magnet goldmine. The Company owns and operates the Mt Magnet, Edna May, Vivien, Marda, Tampia and Penny gold mines, and the recently acquired Rebecca Gold Project, all of which are in Western Australia.

The Technicals

* Please note this is general advice only

Monthly Chart on the Left - Weekly Chart on the Right

Upon taking a closer look at the monthly chart, it becomes evident that this stock has been displaying impressive resilience and strength. It's quite remarkable to note that it hit a low of just 60 cents last year, and since that point, it has shown its mettle with 11 consecutive monthly gains and only 2 minor setbacks.

What really makes this stock stand out is its potential in light of the current geopolitical conflicts. As we navigate through these uncertain times, gold is often seen as a safe haven for investors. With tensions on the rise, it's entirely possible that both gold and gold-related stocks, like the one we're discussing, could experience a significant surge in value.

In essence, this stock not only has a robust track record, in making explosive up moves, but is also poised to benefit from global uncertainties, potentially propelling it to much higher price levels. The force is indeed strong with this one.

When we shift our focus to the weekly chart, a promising trend becomes quite apparent. We're witnessing a series of higher highs and higher lows, unmistakably constituting an uptrend. The stock has not only distanced itself from its recent base but also ventured into a territory where the stop loss might need to be a tad more generous than our preference dictates.

However, there's an underlying strength in this stock that's hard to ignore, and that's what makes it worth considering. I'm willing to take a calculated risk here. If the prevailing sentiment continues, I'll definitely consider tightening up that stop loss. For now, though, I believe it's wise to grant this trade a bit of breathing room.

*Please note this is general advice only.

So, here's the plan: I'm looking at an entry point up to $1.75, with an initial stop loss set at $1.19. It's a bit wider than I'd like, but it's a prudent starting point. We'll reevaluate if and when the stock extends its upward movement. As for our initial target, it's set at $2.50.

Now, a word of caution to anyone thinking of getting in on this trade: It's important to be mindful that the stock has already made significant strides from its base. If you're considering getting in, perhaps consider a slightly lighter position than your usual. It's all about managing the risk while being part of this potentially promising opportunity.

*Please note that the team at TradeProfitably has exposure to the stock

RMS

| 2020 Y | 2021 Y | 2022 Y | |

| REVENUE PER SHARE | 0.46 | 0.59 | 0.49 |

| OPERATING MARGIN (%) | 32.82 | 26.72 | -0.33 |

| NET INCOME, GAAP | 78 | 95 | 9 |

| LONG TERM DEPT | 10 | 7 | 17 |

| ROIC | 26.23 | 19.89 | -0.15 |

| RETURN ON CAPITAL | 25.82 | 20.56 | 1.72 |

| RETURN ON EQUITY | 26.96 | 21.57 | 1.68 |

| FREE CASH FLOW | 0.20 | 0.24 | 0.09 |

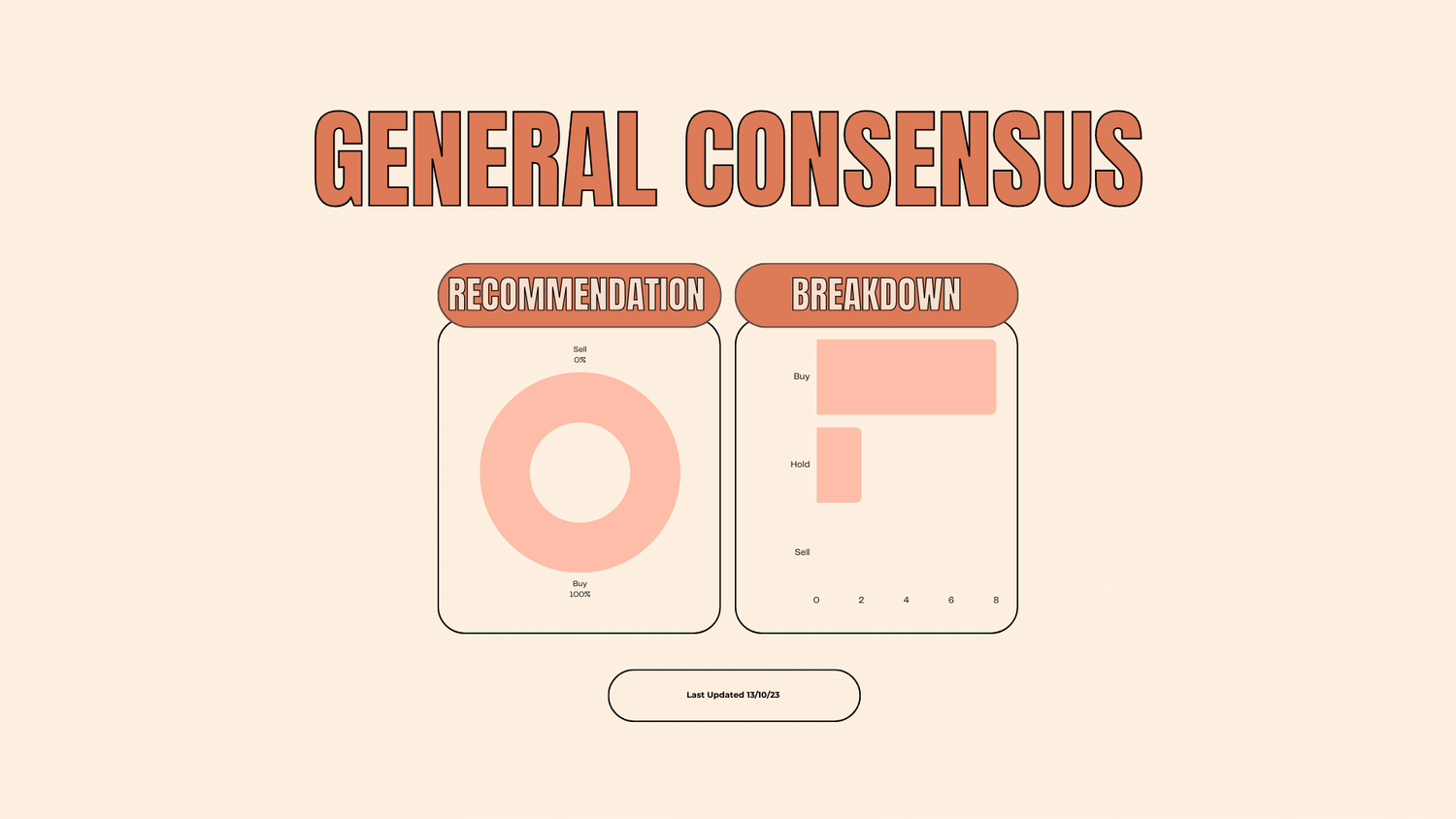

General Consensus

At this moment, it's quite interesting to note that the general consensus on this stock stands at 8 "buy" recommendations and 2 "hold" recommendations. This level of unanimity in favor of "buy" signals a high degree of confidence among market analysts and experts.

However, it's essential to remember that consensus opinions can change rapidly in the world of finance.