Weekly Recap & Forecast

Where we review the past week's performance and provide the likely technical developments and potential trends for the upcoming week(s).

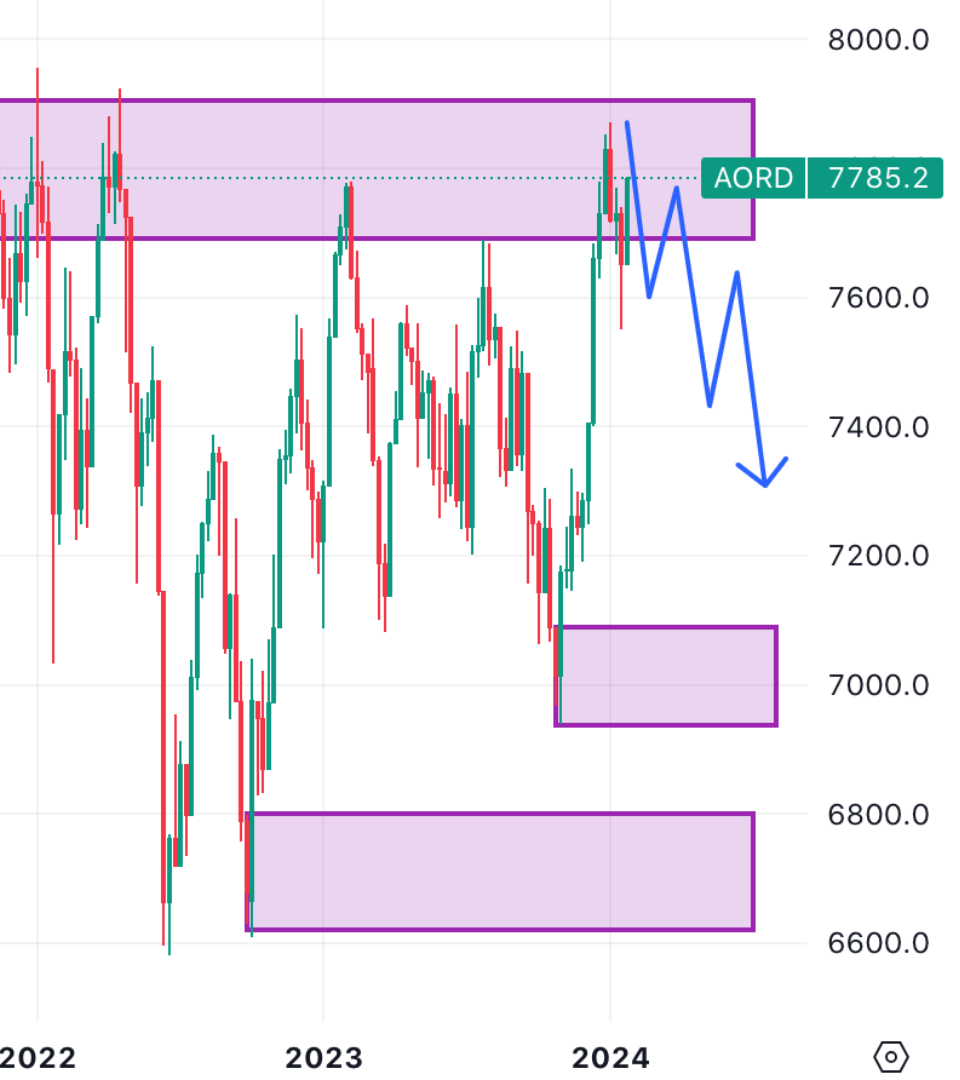

All Ords

A strong rally saw the Australian market back into the ceiling territory which has held firm since middle of 2021. My technical anticipation is that lower prices will follow as this over extended rally has now ran into overhead resistance.

Observe the market as a wall which is being painted. As the market rallies up, it leaves unmitigated levels below. The parabolic rallies without consolidation are followed by pullbacks. Stay cautious.

S&P

The U.S market contrary to the Australian market has managed to have two consecutive weeks closing above the ceiling which held strong since the inception of 2022. With all breakouts, pullbacks are imminent. The rally that the U.S market has had, a reversal and a target of 4400-4500 is expected. Remember buy low and sell high. We are currently sitting at all time highs.

Ring the bell, the geopolitical and inflationary issues must have subsided.

Gold

Gold is still hovering around the highs. It traded abut failed to close above the weekly ceiling which is holding since the middle of 2020. My technical anticipation is for it to fall back towards the $1800 lows.

The flip scenario would be if it started trading higher and used the current ceiling that it’s in as a base. Further upswings need to take place for that to occur. In the meantime buy low and sell high and currently we are high.

I’m staying right out of this one for the moment. I always prefer to be buying at discounts rather than what I perceive to be premium for the moment.

Crude

Crude has had a solid week bouncing off the base formed back in early 2021. Once again, think of the unpainted wall. The brush is being led to the upside with a target of $96.50, followed by $104 and then towards the highs. Stay tuned.

Crypto

Gold is still hovering around the highs. It traded abut failed to close above the weekly ceiling which is holding since the middle of 2020. My technical anticipation is for it to fall back towards the $1800 lows.

The flip scenario would be if it started trading higher and used the current ceiling that it’s in as a base. Further upswings need to take place for that to occur. In the meantime buy low and sell high and currently we are high.