Stock Idea

About the company

Whitehaven Coal (WHC) is an Australian producer of premium-quality coal focused on development and operation of coal mines in New South Wales and Queensland.

The Technicals

* Please note this is general advice only

Monthly Chart on the Left - Weekly Chart on the Right

Analyzing the monthly chart to our left, it is evident that the stock has displayed a remarkable performance since the lows experienced in 2020. With a surge from slightly below $1 to recent peaks of $11, the recent pullback has presented an appealing buying opportunity.

The consolidation and subsequent rebound from the $6 level have formed a solid foundation for our trade.

Shifting our attention to the weekly chart on the right, it is observable that the stock is establishing a pattern of ascending peaks and higher troughs, indicative of an upward trend.

It's worth noting that geopolitical uncertainties and conflicts remain a significant factor, and we should exercise caution when considering exposure to stocks in such conditions. Nonetheless, it's a well-established fact that markets tend to thrive even in conflict-ridden scenarios.

With that in mind, here's the proposed technical trade: I am currently considering an entry point up to $7.75, with the stock trading at $7.60 as I compose this statement. I have set my stop loss at $6.60, and I am targeting the previous high of $11.

I would like to emphasize the importance of prudent position sizing. Trading is not only about having an edge but also about effectively managing risk, assessing the risk-to-reward ratio, and practicing sound money management principles.

* Please note this is general advice only

*Please note that the team at TradeProfitably has exposure to the stock

WHC

| 2020 Y | 2021 Y | 2022 Y | |

| REVENUE PER SHARE | 1.20 | 1.17 | 3.44 |

| OPERATING MARGIN (%) | 11.77 | 3.21 | 66.54 |

| NET INCOME, GAAP | 21 | -408 | 1347 |

| LONG TERM DEPT | 651 | 688 | 115 |

| ROIC | 3.47 | -- | 49.65 |

| RETURN ON CAPITAL | 1.21 | -- | 49.65 |

| RETURN ON EQUITY | 0.88 | -19.18 | 54.72 |

| FREE CASH FLOW | -0.03 | 0.06 | 1.75 |

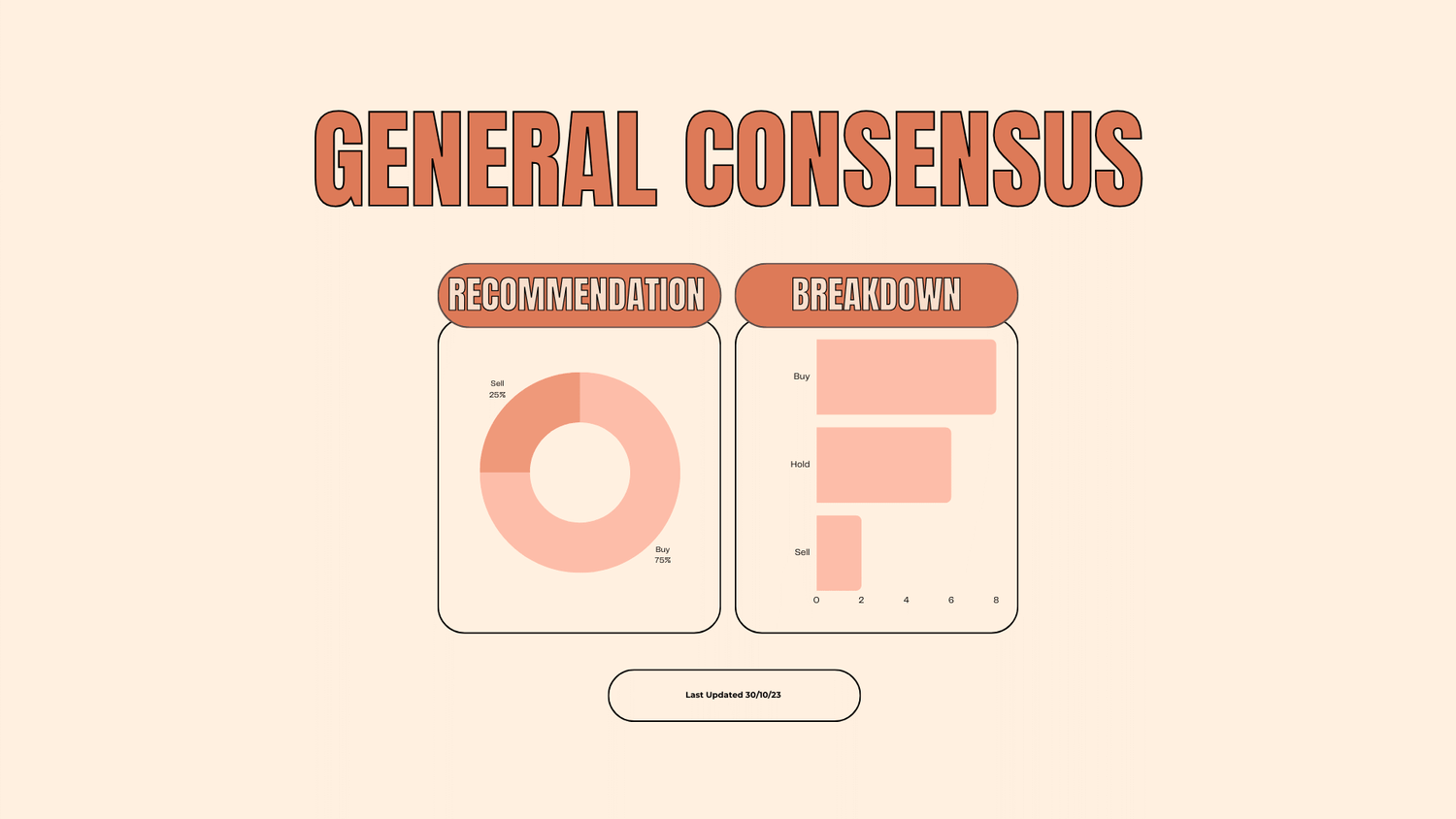

General Consensus

The general consensus on the stock is a hold, with 6 brokers calling it a Buy, 2 a Sell and 8 a hold.